The Single Best Strategy To Use For what does an atm skimmer look like

Check out the buttons to see if lines, arrows, along with other graphics are lined up properly. If a graphic is partly included or doesn't align thoroughly, it could be because there is a fake situation hooked up to the buttons. typical ATMs mustn't have skewed, covered, or cut-off graphics and styles.[6] website X exploration supply

keep track of your accounts usually – Monitor your accounts routinely for strange activity. create alerts and Look ahead to nearly anything that appears to be strange. in case you detect your facts has been compromised, Speak to your financial institution immediately.

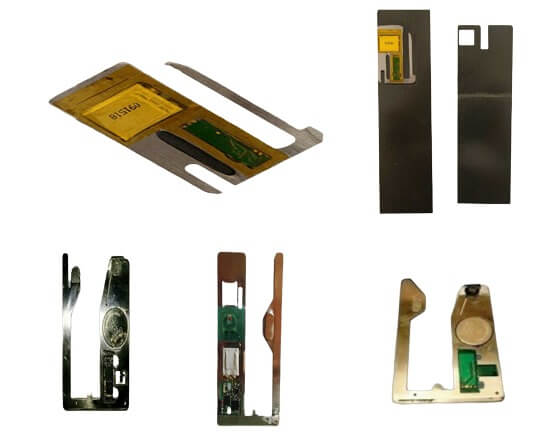

plenty of you are actually inquiring to see what a skimmer looks like prior to it’s yanked off an ATM. Are they simple to location or just about unnoticeable? Our reader Timeus functions for your bank and specials with this kind of matter each day, and he despatched in the subsequent pictures. get pleasure from.

Fraudsters can try and theft the info of a financial institution card of its proprietor, making use of Exclusive copying gadgets inside the factors of use of cards (ATMs, payment terminals, and many others.

See that grey rectangular box? That box was hooked up on the lights previously mentioned the ATM screen. should you look intently, the thing is a small pinhole in that box?

analyze the Keypad: Does the keypad look a tiny bit also thick, or diverse from how it usually looks if you've applied the machine before? it could be an overlay around the actual keypad.

Look for doable skimming gadgets - which could consist of sticky residue and attachments on the card slot

follow ATMs in effectively-lit locations: usually situations, scammers won't try and set skimmers on ATMs within banks or in large-visitors, very well-lit areas because it is more challenging to get away with it.

Shimming will involve reading and thieving card chip information and facts. It’s even now essential to look out for signs of skimming or shimming gadgets regardless if employing a debit card by using a chip at an ATM.

utilizing your hand to cover the pad though moving into your PIN will avoid anyone or something from looking at your PIN and utilizing it to accessibility your account.

The card reader must be moved ahead of inserting the cardboard. modern day ATMs are characterized by a robust and reliable building, so a moving card reader can suggest the presence of the skimmer. The skimmer may be attached by the use of tape or glue.

The presence on the camera is usually evidenced by a small melancholy resembling a black dot. Before using the ATM, you ought to cautiously inspect it for your slightest holes and recesses. In addition, you should go over the keypad with the absolutely free hand when coming into the PIN-code.

fearful? the main move to defending by yourself from these scammers is to grasp more about them. Continue reading for a whole rundown with the means they attempt to steal your facts—and your money.

Check your account: you ought to overview your account assertion for just about any unconventional or unauthorized transactions. frequently periods, criminals will try and act fast by getting the most out of a stolen card as soon as possible. Look for giant transactions relating to technological innovation, appliances, vacation, and the rest Which may look out of the ordinary.